Mansion House Shake-up: UK’s regulatory Red Tape Revolution

Mansion House Shake-Up

The Mansion House in London has hosted City grandees and government ministers for nearly two centuries. In July 2025, it became the stage for a different kind of performance. Newly appointed Chancellor Rachel Reeves announced a sweeping overhaul of the U.K.’s financial‑services rulebook, a plan she dubbed the Mansion House Shake‑Up. The message is unmistakable: for Britain’s economy to thrive, we must eliminate outdated regulations that hinder capital flow and simplify the complicated red tape entrepreneurs face. With a bold and proactive approach, Reeves has already begun to tackle these challenges, inspiring many and sparking discussions among others. This is a significant step towards a brighter economic future!

Deregulation

At the heart of the reforms is a push to unlock the country’s vast pension savings. U.K. pension funds control more than £2.5 trillion in assets, yet only a tiny sliver is invested in high‑growth sectors like technology and infrastructure. The Mansion House compact, first floated under the previous Conservative government and now reinterpreted by Labour, encourages defined‑contribution schemes to allocate up to 5 percent of their portfolios to unlisted equities and venture funds. Reeves claims that if even half of eligible schemes follow the guidance, it could unleash £50 billion in patient capital over the next decade—a sum that could fund new wind farms, AI research labs, and biotech start-ups. Critics worry about the risk profile of such investments. Still, supporters argue that long-term savers deserve a share of the upside that global pension giants, such as Canada’s CPP and Australia’s super funds, enjoy.

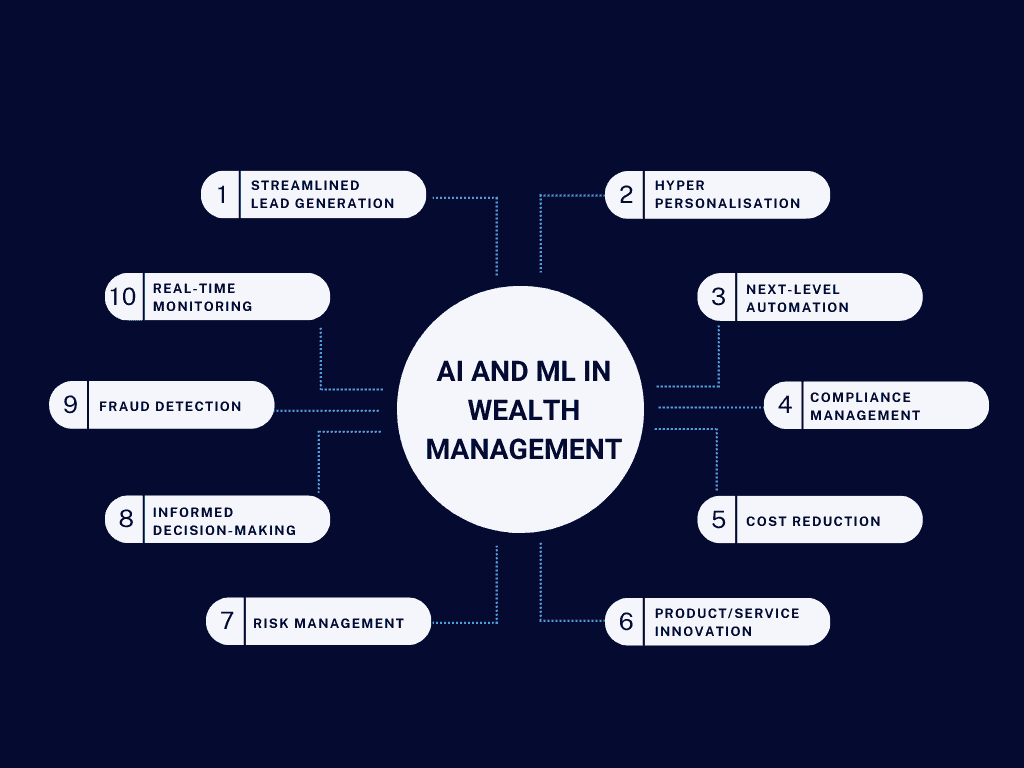

The shake‑up doesn’t stop at pensions. Reeves promised to scrap or simplify more than 100 regulations inherited from the European Union’s MiFID II, Solvency II and PRIIPs rulebooks. Research unbundling requirements that forced brokers to charge separately for analyst reports will be relaxed. Insurers will be permitted to allocate more capital to infrastructure. The Financial Conduct Authority and Prudential Regulation Authority will be given a new secondary “competitiveness duty,” requiring them to weigh the impact of their rules on economic growth. Reeves also pledged to review the Senior Managers Regime, which holds executives personally accountable for misconduct, and to expedite licence approvals for fintech start-ups.

There are risks in deregulation. The 2008 financial crisis serves as a cautionary tale about what happens when regulators prioritize competitiveness over stability. Reeves insists that consumer protection and economic stability will remain paramount, but the devil is in the details. Some consumer advocates worry that loosening MiFID II’s research rules could reduce transparency and enable more conflicts of interest. Environmental groups argue that redirecting pension cash into “growth assets” could sideline green goals if regulators don’t set clear sustainability criteria. Labour’s plan to allow the financial services sector to self-certify some products has raised eyebrows among those who recall the mis-selling scandals of the 1990s.

Still, the urgency is palpable. Britain has posted years of sluggish productivity growth and lags behind its G7 peers on investment. Since Brexit, London’s status as Europe’s top finance hub has come under pressure from Paris, Frankfurt and Amsterdam. Reeves’ Mansion House agenda is an attempt to make the City a magnet for capital again without sparking another race to the bottom. There is precedent: countries like Canada and Australia have long allowed pension funds to invest heavily in infrastructure and private equity, and their retirement systems remain among the most secure in the world.

Will The Reforms Succeed?

Whether the reforms succeed will depend on execution. Convincing hundreds of pension trustees to shift assets into riskier classes is no small task. Regulatory agencies must balance their new competitiveness mandate with their traditional safety and regulatory roles. And perhaps most importantly, the government will need to demonstrate that cutting red tape can translate into tangible economic benefits—such as new semiconductor plants, net-zero upgrades to council estates, or digital ID schemes that make life easier for small businesses. The Mansion House may never have seen a performance quite like this: a government promising to set capital free while keeping the guardians at their posts. As with any magic show, the audience will be watching closely to see whether the trick ends with applause or an embarrassing reveal.