B2B BNPL: The Future of Business Payments or a Risky Bet?

Imagine you are the CFO of a mid-sized manufacturing firm that needs urgent machinery upgrades to stay competitive. The cost? $ 100,000. You know the upfront expenditure could strain cash flow. You can ask the bank, but commercial loans take a while to process, and time is short. You sigh, thinking, ‘There’s got to be a better way. ’ Then, the supplier offers a Buy Now, Pay Later (BNPL) option—allowing payments in instalments over the next 12 months. The deal closes, production ramps up, and the firm thrives. That’s how FinTech-fueled B2B BNPL solutions lubricate the gears of business transactions.

The numbers tell an equally compelling story. In 2023, the global B2B BNPL market reached a remarkable value of $ 14 billion in transactions. The broader BNPL market is expected to mark 106% growth by 2028, ballooning to $ 687 billion in value.

But there lies an interesting question behind this optimism: Is B2B BNPL the future of business payments or a risky bet? Let’s explore this duality to uncover whether this FinTech innovation is a game-changer or the first domino in a potentially catastrophic sequence.

B2B BNPL (Buy Now, Pay Later) – A Game Changing Financial Revolution

When you compare it with its consumer counterpart, B2B BNPL is still in its infancy regarding market size, user base, transaction volume and adoption rates. E-commerce integration and higher preference by Gen Z and Millennial consumers have played a crucial role in the exponential growth of the B2C BNPL segment. However, when it comes to transaction value, B2B BNPL deals with significantly larger values—often seven times higher than B2C—making it a powerful tool.

With growing demand, the B2B BNPL segment has gained global traction recently. Here are various factors driving this growth of the B2B Buy Now Pay Later solution:

- A digital transformation, like the shift to an online B2B marketplace and e-commerce expansion, makes BNPL an attractive payment choice.

- Liquidity needs of SMEs (small and medium-sized enterprises) to improve cash flow management. Simple processes and quick approvals make it easier for SMEs to access capital.

- Global expansion and simplifying trade make BNPL an appealing option for businesses. BNPL makes cross-border payment easier with standardized credit terms and creates opportunities for recurrent purchases.

- Regulatory support and a favourable framework for FinTech innovations help adopt B2B BNPL solutions.

Key Players Driving B2B BNPL Innovation

Specific industries, such as technology, manufacturing, wholesale, and healthcare, are increasingly integrating BNPL into their digital payment infrastructure. For instance, manufacturing firms use it for equipment purchases, and the wholesale industry uses it for bulk orders. Here are some leading FinTech providers in the B2B BNPL (Buy Now Pay Later) space:

- Resolve Pay offers white-label, customizable embedded B2B BNPL solutions.

- Hokodo offers Buy Now Pay Later solutions for B2B sales, simplifying trade credit with flexible terms. Last year, Hokodo raised a € 100 million debt facility from Viola Credit to boost B2B payment solutions.

- Credit Key offers unparalleled flexibility to businesses by providing B2B BNPL.

- Uplift offers Buy Now, Pay Later (BNPL) solutions for the travel industry.

- Ratio Tech offers BNPL solutions on flexible payment terms for technology and SaaS companies for technology procurement.

Navigating Future Trajectories

According to projections, the B2B Buy Now, Pay Later (BNPL) market will be a trillion-dollar opportunity in the next five years. The market is expected to grow at a double-digit rate and account for approximately 15% to 20% of the total BNPL transaction volume by 2030, which is estimated to be around €25 to € 30 trillion.

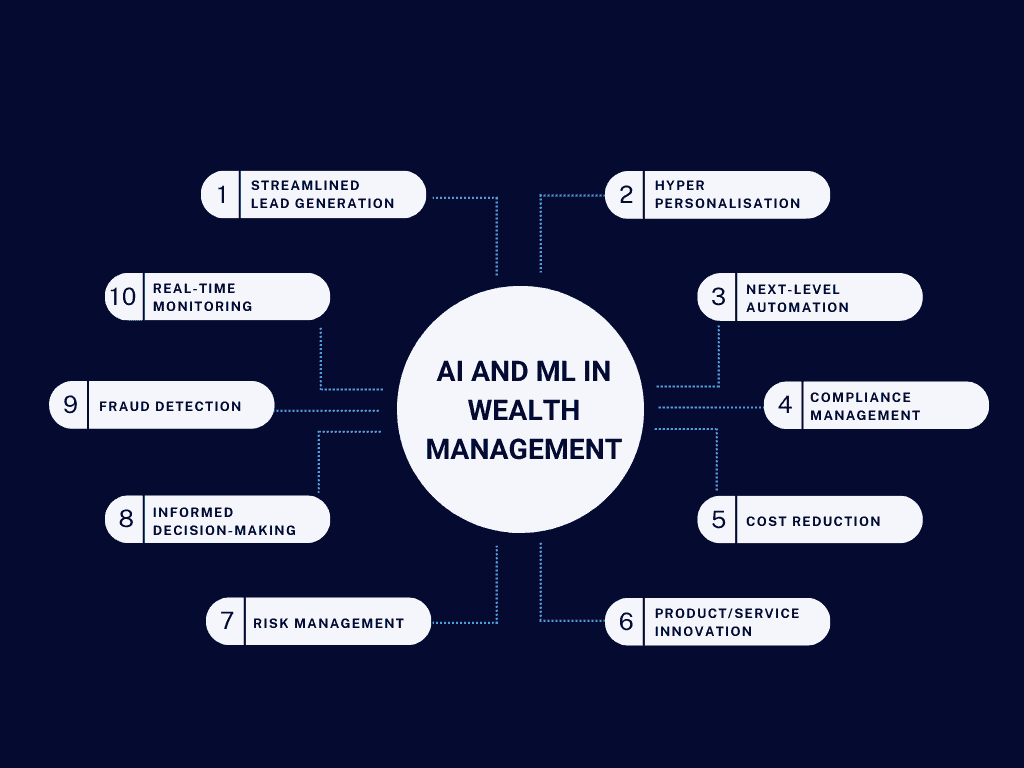

The increasing integration of AI and blockchain technologies into B2B BNPL solutions will make them even more efficient and secure. With surging investment inflows, more FinTechs are likely to enter the B2B BNPL market, driving innovation in the digital payment space. Increasing demand and the adoption of companies in various sectors indicate market confidence and the potential for significant growth in the future.

The Flip Side of B2B Buy Now, Pay Later (BNPL) Solution

Remember what happened with B2C BNPL? Mounting debt, missed payments, late fees, regulatory crackdowns and more. Studies from 2021 show that 72% of BNPL users who missed their payment reported its adverse impact on their credit score. Nearly 43% of BNPL users in the USA made a late payment.

So now, as this BNPL model is increasingly getting adopted in business finance, it is essential to consider the risks. Here are the potential risks:

- It can impact the financial discipline of companies that may overuse BNPL, increasing the risk of debt accumulation

- Flexible payment terms can increase liquidity in inventory if not appropriately managed.

- Merchant costs can increase (2% to 8% of sales) by opting for a BNPL solution.

- The default/late payment risk requires a complex underwriting process. The Consumer Financial Protection Bureau (CFPB) regulates BNPL solutions, including B2B BNPL, by classifying them as credit card-like products under the Truth in Lending Act and requiring dispute resolution, refund processing, and periodic billing statements to ensure consumer protections.

- Rapid growth in the segment has put it under strict regulatory scrutiny. In 2022, the CFPB (Consumer Financial Protection Bureau) issued a report highlighting the risks associated with BNPL, including inconsistent consumer protections and debt accumulation.

Conclusion

Despite the challenges and hurdles B2B BNPL providers face, businesses and investors are leaning into their potential. Consider Modifi, a B2B BNPL platform that secured $15 million in funding this year, or Affirm’s $4 billion capital partnership with Sixth Capital—clear signals of heavy investment in this space. These moves underscore the belief that B2B BNPL can transform business payments.

But here’s the key: the future of B2B BNPL isn’t just about innovation or growth; it’s about balance. To succeed, B2B BNPL providers must carefully navigate the fine line between offering innovative solutions and managing risk.